According to a new report released today by global measurement company, Nielsen, the competitive landscape is shifting in Southeast Asia where multinational companies (MNCs) have traditionally dominated many markets.

Empowered by low running costs, well-established networks, an intimate understanding of local needs and tastes, and the ability to move swiftly, local players have become a force to be reckoned with, and have irreversibly re-shaped Asia’s FMCG sector.

“The entry of multinational companies (MNCs) into new markets—while presenting advantages for local consumers who gain access to a greater range of products—can be a big challenge for local companies, which are suddenly faced with daunting foreign rivals that have an array of advantages, including vast financial resources, diverse talent pools, sophisticated technology infrastructures and well-established delivery and operating practices,” says Laura McCullough, Managing Director, Client Service Leader of Nielsen’s growth and emerging markets. “However, in recent years many local companies have not only survived the competition from multinationals, but have outperformed them in Southeast Asia.”

The Nielsen report, Go Glocal identifies the top four factors that have tipped the balance to local companies’ favour:

Value for money, national and pride and familiarity engender loyalty for local brands: Consumer sentiment is a contributing factor to this rebalancing toward Asian players. Consumer preference has started to favour regional and local brands over global brands. The key factors contributing to this include value for money, a desire to support home-grown brands, and having had a positive experience previously.

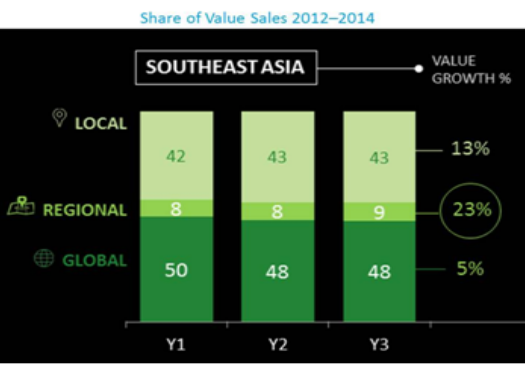

Regional and local brands are growing faster than global players in both modern and traditional trade: For local players their success has been a slow evolution as their knowledge of the modern trade environment grew particularly in areas such as category management.

Local companies understand nuances of local consumers: Almost three in five consumers in Southeast Asia believe local brands are most attuned to their personal needs and tastes.

Local and regional companies offer price spectrum to match consumer needs: The emergence of a growing middle class has fanned aspirations for consumers to trade up and enjoy the perceived additional quality and functional benefits of more premium priced products.

“Consumers have never before been as informed, empowered and ready to embrace brands that understand their lifestyle requirements and needs. Companies – be they global, regional or local must ensure their brands deliver on their value proposition and fulfil a critical role in lives of consumers if they are to win the battle of choices,” concludes McCullough.