The Association of Radio Operators for India (AROI), has asked for immediate government intervention as the industry faces a deep existential crisis, which had been made worse by the coronavirus pandemic.

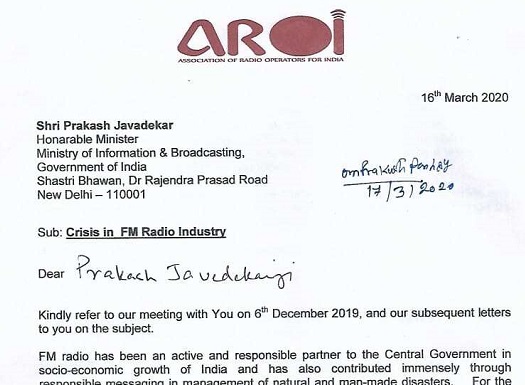

In a letter to the Minister of Information & broadcasting, Prakash Javadekar, the industry body said that advertising revenues have been shrinking over the last year and with the coronavirus outbreak, all industries and services have made major cuts on advertising spends. There has been a “very steep fall in Government advertising” as well.

In the letter, Anuradha Prasad, President, AROI, has said that this is causing an “unprecedented financial crisis, with many stations contemplating cutting costs to survive, including cutting down staff etc. The industry employs over 20,000 people and in the current situation, it will be very difficult for the industry to sustain this workforce.”

The industry has asked for three immediate steps to save the FM radio industry.

These include:

- One-year moratorium on licence fees and Prasar Bharti charges by the government

- Restoration of government advertising on radio to normal levels

- Payment of Government dues on advertising from Directorate of Advertising and Visual Publicity

AROI has also pointed out that it has been an active and responsible partner to the central government in the country’s socio-economic growth and has also contributed immensely through responsible messaging in management of natural and man-made disasters. It is also the emergency outreach to citizens in India’s towns and cities and many radio channels have won awards from government for their significant role in fighting disasters.

Private FM radio is the only content media industry in the country which pays license fees as well as an annual revenue share to the government. It is dependent on advertising for survival and as per Pitch Madison Advertising Report 2020, radio adex has shrunk to only 3% of the overall ad spends. The medium took a big hit in 2019 with a drop in spends in the second half by 6% on account of slowing down of the economy. Industry experts say that FY20 will close with a degrowth in radio adex to the tune of 20%.

The biggest FM player, ENIL, which operates Radio Mirchi, reported a revenue decline of 12% in the first three quarters of FY20. Its PAT was down about 45% and its stock price has already hit a historical low recently, nearly 75% off from its 52-week high. The other listed company, MBPL, which runs Radio City, has reported a revenue drop of nearly 17% in the three quarters of FY20 with PAT down nearly 40%. Overall, the radio industry is expected to report a contraction of up to 20% in revenue in FY20.

Harshad Jain, Chief Executive, Radio and Entertainment, HT Media Ltd and Next Mediaworks Ltd, said most companies’ P&L was under tremendous pressure, especially since they had invested heavily in acquiring licences in Phase III of the radio auctions.

“The annual licence fee is 4% of gross revenues, apart from Prasar Bharti rentals, which are also exorbitant. Radio stations do so much pro bono work on behalf of the government and, so, in desperate times, a waiver would be helpful,” Prashant Panday, Chief Executive Officer, Radio Mirchi, told Livemint.